1Q23 Semiconductor Foundry Market Analysis, 2Q23 and 2023 Outlook, Wafer Shipments, ASPs, Revenues, Margins, CapEx, Vendor Analysis and Profit Share

Inventories Took a Toll on Foundries; TSMC and Samsung Take 73% Revenue Share

The semiconductor foundry revenue declined for the second consecutive quarter in Q1 2023 and will fall further in Q2 2023. The foundry industry finally caught up with the weakness in Q4 2022 after posting robust growth for two years. As a result of continued weakness in PC, smartphone and data center markets and high fabless and IDM inventories, the foundry market took a tool, resulting in lower utilization rates, margins and revenues for foundries.

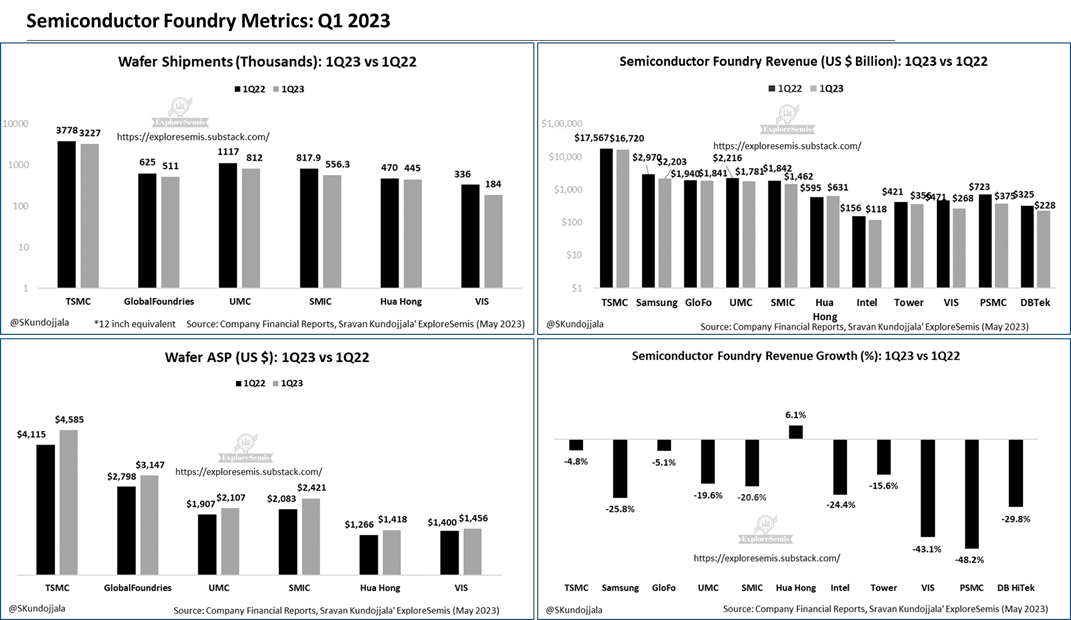

I estimate that the semiconductor foundry market posted -18.8% q/q and -10.9% y/y revenue decline to $25.9 billion. Except for Hua Hong, all major foundries posted q/q and y/y revenue decline.

TSMC increased its share to 64% in Q1 2023, followed by Samsung Foundry with around 9% share. GlobalFoundries overtook UMC to take the number three spot in Q1 2023.

Except for China-based mature node foundry Hua Hong (103.5%), all others saw reduced utilization rates during the quarter. TSMC’s utilization rate, for example, dropped to the low 70s percent. In addition, GlobalFoundries (mid-80s percent), UMC (72%), SMIC (68.1%), PSMC (<60%) and Samsung all took a hit in terms of utilization rates due to reduced orders from customers.

Even IDMs Intel, NXP (low-80s), On Semi (71%), Renesas (<80%), TI etc., also failed to load their factories due to reduced demand. On the other hand, memory companies are caught up in a more severe correction cycle and reduced their wafer starts by 20-25%.

The reduced utilization rate for the second consecutive quarter is a good sign as it can help the market balance supply and demand. Most PC and smartphone chip companies have been undershipping for the last 3-4 quarters. For some, the recovery is around the corner; for others, it may take a quarter or two to see the upturn. Regardless, the world’s largest foundry TSMC will not likely see sequential growth until Q3 2022. Q2 tends to be seasonally a weak quarter for PC and smartphone customers in general. So, the actual recovery will not likely start at least until Q3 2022.

Except for automotive, all other segments (PC, smartphone, data center, IoT and industrial) all underperformed during the quarter. However, even auto customers reported reduced lead times and higher inventory, which could mean the auto will also catch up at some point.

Wafer shipments and revenue declined across the board while ASPs held up well. All leading foundries posted a double-digit y/y ASP increase in 1Q23.

TSMC widened its foundry share lead in Q1 2023 despite a second consecutive q/q revenue decline as it outperformed the broader foundry market growth. Despite 51% of revenue from advanced nodes N7 and N5, the company saw acute weakness in this area due to reduced orders from smartphone and HPC customers. Q1 tends to be a weak quarter for smartphones and PCs, affecting TSMC’s results.

The company’s N7 revenue dropped -24% q/q and -37% y/y. Furthermore, N7 revenue will drop 36% in 2023 to $11.6b.

Despite firm wafer pricing and cost improvements, TSMC’s gross margins took a hit due to reduced utilization rates, inflationary costs, overseas fab expansion and N3 investments. However, the company held up well in terms of ASPs due to a high mix of advanced nodes. TSMC’s revenue will decline further in Q2 2023 due to continued inventory adjustments by its customers. However, the company will see 28% sequential growth in 2H23 due to some recovery in smartphone and HPC orders and the N3 ramp. I expect N3 to contribute around $4b in revenue in 2023, driven primarily by Apple. TSMC’s revenue will decline by around -3% in 2023 while its CapEx will be around $32-$36b. The company’s wafer shipments will decrease by -10%+ while ASPs will grow by 11% in 2023.

Despite demand challenges, TSMC’s wafer capacity will grow by 5% to 16m+ wafer capacity in 2023. Most of the capacity additions will be in N3 and N5 nodes.

TSMC’s utilization rate will drop to 84% in 2023 from 102% in 2022.

Samsung’s foundry utilization rates took a hit due to high customer inventory and Qualcomm’s order shift to TSMC. Qualcomm moved to TSMC for its Snapdragon 8 Gen 1+ and Gen 2 flagship processor manufacturing. However, Samsung Foundry expects some minor recovery in Q2 2023.

Samsung struggled with its advanced yield rates in recent years, but the company is improving in this aspect. Despite its early entry in 3nm with GAA (gate-all-around) architecture, Samsung couldn’t ramp so far. However, the company will likely get traction for its second generation 3nm (3GAP) in 2024 with Android customers.

GlobalFoundries performed well compared to its peers in Q1 2023. The company overtook UMC to become the 3rd largest foundry in revenue. Two-thirds of GloFo’s revenue is single-sourced, meaning the customers have no choice except for GloFo. In recent quarters, the company’s customers pushed orders and took some charges due to a long-term agreement (LTA) breach. GloFo’s LTAs are fixed volume, fixed price and fixed duration with an emphasis on pricing. The company offered an extension of contracts to allow for near-term order push-out for customers.

GloFo is banking on auto-growth to reduce the revenue deficit from smartphones and consumer segments. GloFo’s auto revenue will nearly triple to over $1 b in 2023. The company’s utilization rates dropped to the mid-80s percentage in Q1 2023 and expects Q1 to be the bottom for revenues. GloFo hopes to increase revenue sequentially through 2023 and will likely end the year with a -7% y/y revenue decline.

GloFo has the industry’s highest ASP for mature nodes (28nm and above), even higher than TSMC. The company’s differentiated FD-SOI technology and lock on top customers such as Qualcomm, NXP, Infienon, Samsung, Skyworks, On Semi, AMD, etc. help it maintain high ASPs.

Regarding CapEx, GloFo will reduce its CapEx to $2.2 b in 2023 from $3.1 b in 2022. In addition, the company hopes to increase its wafer capacity by 200k to 2.8 million in 2023 and 3 million in 2024.

UMC, a mature node foundry, again underperformed due to customer inventory adjustments. The company’s utilization rate dropped to 72% in 1Q23 from 87% in 4Q22. Except for automotive, all other segments underperformed. UMC’s revenue will likely stay flat in Q2 2023, while the utilization rate will be around 70%. The company’s 2023 CapEx will increase by 11% to $3b (90% on 300mm), with most of the CapEx will go to 22nm/28nm capacity expansion. The company expects its 28nm utilization to recover to 90% later this year. 80% of UMC’s 28nm capacity is protected by LTAs. UMC’s capacity will increase by 5% in 2023 and 2024. Like other foundries, UMC also held up well with its wafer ASPs.

SMIC’s challenges continued with reduced demand from China customers. Its utilization rates dropped to 68% in 1Q23 from 80% in 4Q22. SMIC, however, will turn the corner in 2Q23 with around 5% sequential growth, driven by demand recovery in 40nm and 28nm. SMIC will spend $6.3b CapEx in 2023 (flat vs 2022) to further expand its 28nm capacity. Despite its capabilities in 14nm, I think it is not a high priority for SMIC. 14nm is dilutive to its margins, and I feel 28nm investments have a better return. The company is not yet affected by restrictions much as the company focuses on 28nm and above nodes. However, I see increased demand from end-user device manufacturers to source locally-made chips. The trend has fuelled increased investments in the US, Europe and Japan recently. Nevertheless, SMIC remains a crucial source of mature node foundry for global and Chinese chip vendors.

Hua Hong, a China-based mature node foundry, posted a modest q/q growth in Q1 2023 and guided a flat Q2. The company saw a 100%+ utilization rate yet again, despite a demand drop, thanks to demand in embedded memories and discrete components, which account for more than 70% of its revenue. In addition, 40% of the company’s revenue comes from 300mm wafers and the rest from 200mm. Three-fourths of Hua Hong’s revenue comes from China-based customers. Almost 60% of Hua Hong’s income comes from consumer electronics applications and around 30% from auto & industrial applications.

Intel’s inconsistent foundry story continued in Q1 2023. Revenue dropped -24% y/y. The company derives its foundry revenue from mas-making equipment tools, advanced packaging (Amazon), auto and legacy Intel Custom Foundry deals. Most recently, intel signed MediaTek as a foundry customer for its mature node offering Intel 16. MediaTek will manufacture Wi-Fi and digital TV chips on Intel 16. In addition, Intel is in the process of acquiring Tower. Intel will exit 2023 with around $2.2 b foundry revenue if the deal goes through. Intel offers Intel 16, Intel 3 (2024) and Intel 18A (2025) foundry nodes and aims to compete with TSMC and Samsung. The company claims to have engaged with 7 of the top 10 fabless companies and has a deal value of $3b.

Intel plans to bring more accountability to its foundry design divisions. As a part of that plan, the company will establish a separate profit and loss model for its foundry (internal and external manufacturing). This is equivalent to a spinoff, but the division will stay with Intel. The company enjoyed margin stacking in its heyday but recently struggled with margins.

In summary, Q1 2023 played out as expected for the foundry industry. High customer inventories pushed foundries to reduce their wafer starts. However, Q2 will likely see a minor uptick for GloFo, UMC, Samsung and SMIC. However, TSMC will suffer in Q2 due to weak seasonality and high exposure to smartphone and PC segments.

The foundry industry will decline -5% q/q in 2Q23. Most OEMs (PC, smartphone, data center) are in cautious mode, but all leading foundries could see healthy sequential growth in 2H23. I forecast the foundry industry will decline high single-digit percentage y/y to $113 million in 2023.

Took a ‘toll’ in 1st paragraph