Apple-Broadcom New Agreement: What does it mean? Broadcom's Apple revenue estimate, Apple's RF front-end content estimate and wireless revenue split by component

Broadcom extended its Apple agreement to extend the life of its wireless business (unsurprisingly). Broadcom's previous contract with Apple will expire by mid-2023, and there has been speculation about the relationship's future. However, people paying close attention to Broadcom's earnings calls and executive statements at investor conferences realise that the company never doubted this strategic relationship and hinted at its continuation.

Here is a quote from the 1QFY23 earnings call from Broadcom's CEO Hock Tan on Apple's relationship status.

''our strategic engagement continues very much the same as it has for the last multiple years. And we see that to continue in a fairly predictable, stable manner''

Broadcom's wireless division is the lowest margin business among all its segments, and Apple single headedly drives wireless division growth.

Firstly, the announcement means Apple is not as serious about replacing Broadcom as it did with other suppliers, including Intel and Qualcomm. Secondly, Apple is not interested in the outright acquisition of Broadcom's wireless business yet again. Thirdly, the announcement cools off the speculation about Qualcomm potentially taking the RF filter slot from Broadcom at Apple. Finally, the agreement is good news for Apple's other RF frond-end suppliers, Qorvo and Skyworks, who also have Apple-centric businesses.

Some history. Broadcom and Apple's relationship went back to the original iPhone in 2007. Broadcom started with a touch controller and gradually expanded its content at Apple with Wi-Fi/Bluetooth combo connectivity chips and later with RF components (filters and power amplifiers) after the Avago acquisition in 2016. Broadcom manufactures RF filters in-house (US and Singapore), which account for around 16% of its total wafer volume.

Apple accounted for 20% of Broadcom’s revenue in FY22.

Broadcom's wireless business included cellular basebands, too, at some point. The company has a long history of designing basebands but gave up by 2014 as it couldn't compete with Qualcomm and MediaTek in the mid-range. The baseband venture proved to be a considerable R&D burden for Broadcom at that time. The company had some success with Samsung and other Android makers in the baseband market then. Still, it was never a contender for Apple's slim baseband business (modem without apps processor capability).

While some of its competitors enjoyed the baseband dominance to compete in connectivity and RF front-end markets by offering a complete platform, Broadcom had to compete on a stand-alone basis. As a result, the company limited itself to the premium tier Android and iOS markets only. OEMs welcome performance over pricing in the premium tier markets.

Unsurprisingly, Broadcom flourished with the connectivity and RF front-end design-wins at Apple and Android companies (Samsung, Xiaomi, Huawei etc.). However, even premium Android OEMs moved to Qualcomm and MediaTek's connectivity platforms in recent years, leaving Broadcom solely dependent on Apple.

Apple sources RF front-end modules, FBAR filters, power amplifiers, Wi-Fi/Bluetooth combo connectivity chips, GPS/GNSS chips, wireless charging chips and custom touch controllers from Broadcom and uses those chips in various devices, including iPhone, iPad, Apple Watch etc.

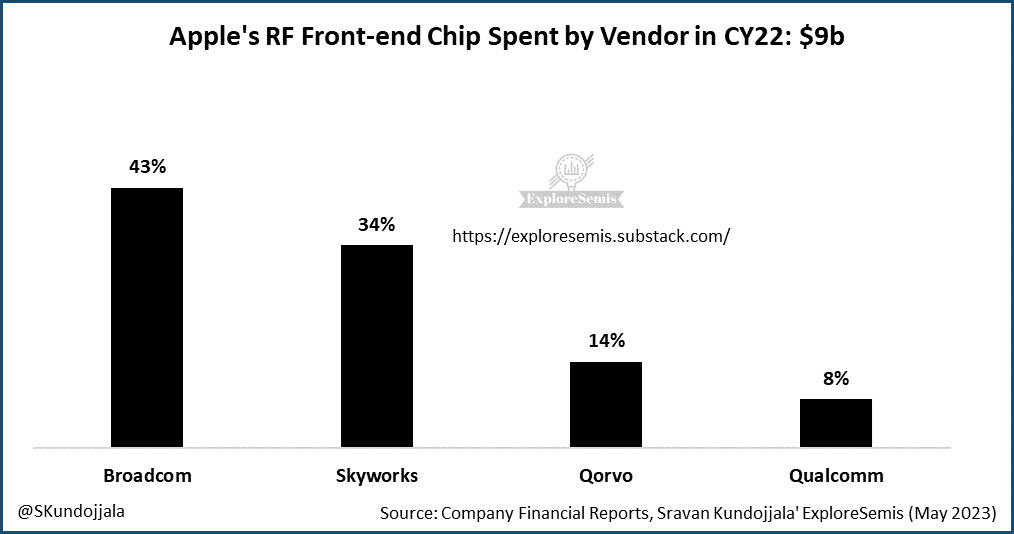

I estimate that Apple spent $9 b on RF front-end components, of which the lion's share went to Broadcom, followed by Skyworks, Qorvo and Qualcomm. Apple spent more on RF front-end components than 5G baseband modems in 2022. I estimate that Apple RF suppliers grew their content by more than 50% in the 5G cycle compared to the 4G cycle.

Apple spent nearly $18 b on 5G modem, RF front-end and connectivity components in 2022 or well above $70 per cellular-enabled iOS device.

Broadcom's Apple revenue peaked at $5.2 b in the 4G cycle before bottoming at $3.6 b in FY20. However, the company dramatically increased its dollar content in the 5G cycle and grew its Apple revenue to $6.6 b in FY22.

At some point, Classic Avago had up to 50% revenue from wireless components and 45%+ operating margins. However, the combined company's wireless margins went down post-Broadcom acquisition. Wireless happens to be the lowest-margin business for Broadcom currently.

Broadcom unsuccessfully attempted to acquire Qualcomm in 2017 to reduce Apple dependency and expand its revenue further. After the failure of Qualcomm acquisition, Broadcom acquired multiple software companies to diversify its revenue streams. As a result, software revenue accounts for 25% of Broadcom's total revenue today.

With failed Qualcomm bid, increased Apple dependency, a low margin profile of the wireless business and a software pivot, Broadcom lost interest in its wireless business. As a result, the company classified it as a financial asset rather than a strategic asset by the end of FY 2019. The company even offloaded parts of its wireless business to Cypress (IoT connectivity) and Synaptics (IoT connectivity) in 2016 and 2020, respectively, while retaining the smartphone-centric wireless business to continue to serve its largest customer Apple.

Broadcom's wireless revenue split is dominated by RF filters followed by connectivity. Based on my estimate, the company's RF filter revenue at Apple grew at 22% CAGR between FY19 and FY22, while connectivity revenue grew at 13% CAGR.

So, Broadcom quickly changed its mind by the end of 1QFY20 and decided to keep the wireless business. I believe the company unsuccessfully courted Apple to acquire its wireless business during this time. However, Apple signed a 3-year deal worth $15b with Broadcom in early 2020 to secure its 5G future.

So, the new agreement extends this relationship further. Wireless accounts for 30% of Broadcom's semiconductor revenue and the extension removes uncertainty on the largest revenue stream for Broadcom. However, the press release doesn't tell how long this will last.

The eventual fate of Broadcom's wireless division lies in Apple, and Broadcom has no control over it. Given its multi-billion dollar price tag, it is hard to think of any acquirers at this point. At some point, Apple may subsume this group's engineering talent and bring it in-house. Until then, Broadcom's 30% of semiconductor revenue's fate hangs in the air.

Disclaimer: This is not investment advice. All opinions are mine only.