Assessing Qualcomm's PC Opportunity; Incremental revenue for Qualcomm; Share and forecast; x86 notebook PC processor revenue share trends

Qualcomm's name is synonymous with smartphones. But, the company is diversifying to reduce its dependence on smartphones. PC is one opportunity the company has long been trying to break into.

Despite its long association with Microsoft on Windows, Qualcomm's PC chip record leaves much to be desired. Yet, surprisingly, the management continued to drumbeat about its future PC revenue streams. In this post, I try to size Qualcomm's potential notebook PC processor opportunity, x86 market size and potential incremental revenues for Qualcomm.

Qualcomm has made several attempts to break into the PC market before without much success to date. Some of those attempts include smart displays and netbooks in 2009-10, Windows RT on Arm in 2012, Windows 10 on Arm (again) in 2017 and Nuvia acquisition in 2021.

Qualcomm moved to semi-custom CPU architectures in 2017 and even discontinued its custom effort by 2018 by exiting from server chips. The company collaborated with Arm to develop semi-custom cores as it saw diminishing returns on custom CPU architecture. Around this time, the company re-entered the PC market with Snapdragon 835 (a smartphone-centric chip) and pushed ahead with cellular-enabled PC chips, which received a lukewarm response from PC OEMs.

Between 2017 and 2023, Qualcomm released 9 PC chips so far and even managed to score design wins with all top-tier PC OEMs, including Dell, Lenovo, H-P, Acer, Asus and Samsung. While these OEMs sampled Qualcomm's chips for ad-hoc devices, they didn't commit their roadmap to Qualcomm's chips. Part of this can be attributed to Qualcomm's less competitive products vs Apple, Intel and AMD, immature software ecosystem, limited channel support and less enthusiasm for cellular PCs. With Windows PC not going far, Qualcomm also threw the hat in Chromebooks.

Qualcomm realised the need for custom cores and acquired Nuvia, the company that was designing server-centric CPUs. Unsurprisingly, Qualcomm gave more weightage to PCs than smartphones with Nuvia. At its 2021 investor day, Qualcomm promised to deliver the first samples of the Nuvia chip by September 2022. The latest is that the company is targeting to have samples later this year and ramp up in 2024.

People familiar with the dynamics of the PC market recognise that the market moves relatively slower than smartphones, and new products tend to come in the holiday season (4QCY24). With just one-quarter time to ramp up, we are unlikely to see any dramatic rise in Qualcomm's 2024 PC chip shipments. The actual ramp is due in 2025. The chip will compete

I estimate that Qualcomm had less than 1 percent share in PC processors in 2022 and shipped less than 1.5 million PC chips (Windows and Chromebook). Also, I estimate that the company is spending to the tune of $800-$900 m R&D on computing chips (PC, tablet and XR).

So, from here, where does Qualcomm go?

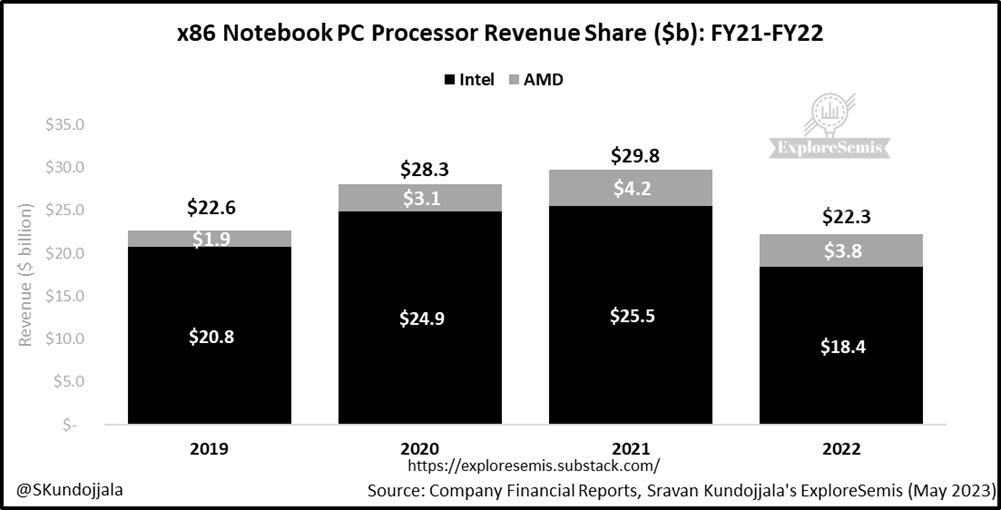

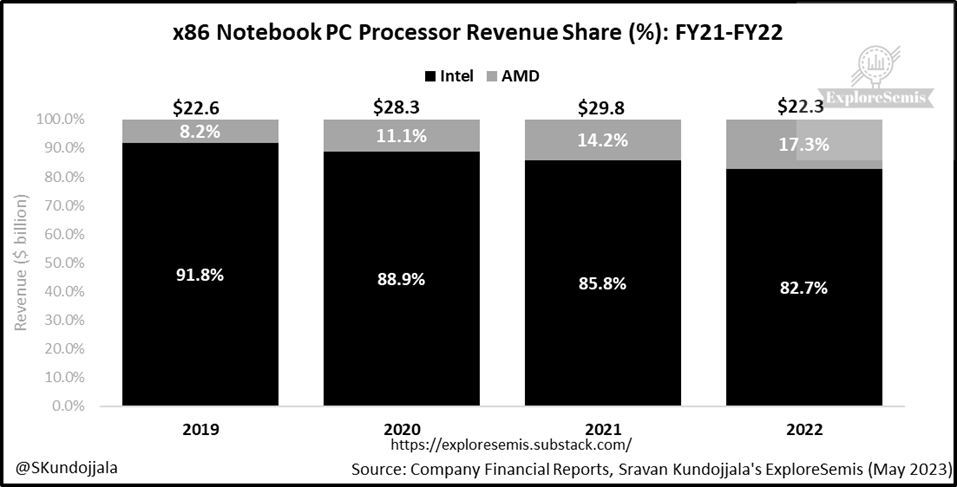

The x86 notebook PC market is a duopoly between Intel and AMD. I estimate the x86 PC market declined 25.1% to $22.3 b in CY2022. AMD increased its share to 17% in 2022 from 8% in 2019, driven by its Ryzen-branded processor growth. CY22 x86 notebook PC processor market size dropped to pre-COVID levels.

Qualcomm currently includes its PC chip revenue in the IoT segment. I estimate that Qualcomm's IoT chip revenue will grow at a 10% CAGR between FY22 and FY30. Also, I calculate that Qualcomm's PC chip revenue has the potential to drive up to 50% incremental revenue on an average between FY25 and FY31.

Despite the FY24 launch, I expect the real volume will kick off only in FY25. As a result, I estimate Qualcomm's notebook PC processor revenue will cross the $500 m mark in FY25 and reach up to $4b by FY30.

Regarding unit share, I currently model Qualcomm's notebook PC share to hit the double-digit percentage by FY29 and overtake Apple in the Arm-based notebook PC processor market.

For this calculation, I have discounted Qualcomm's potential gains in the desktop PC processor market, which could offer up to a 20% upside to Qualcomm's PC chip revenue.

As per the legal battle with Arm, I am not too worried about it as I expect both companies to settle it out of court (the trial is scheduled to begin in September 2024). The core issue at the legal battle is the royalty rate Nuvia is supposed to pay post-Qualcomm acquisition. Arm typically gets lower royalties from custom licenses vs standard licensees. I estimate Qualcomm contributed $350m+ revenue to Arm in royalties and licensing in CY22 and is a significant customer. Arm gets 86% of its revenue from the top 20 customers, and the company must maintain smooth relations with leading licensees such as Qualcomm.

In summary, the PC opportunity remains attractive for Qualcomm as the company can harvest the technologies developed for smartphones. But it all depends on Nuvia's execution and channel strength build-up.

Disclaimer: This is not investment advice. All opinions are mine only.

Last chart: no need for $Billions :)

Nice to see you in Substack too!