Qualcomm: Apple Dependency (Part 2)

Apple revenue contribution forecast through FY31, non-handset chip revenue forecast by segment, Android revenue forecast and non-handset crossover

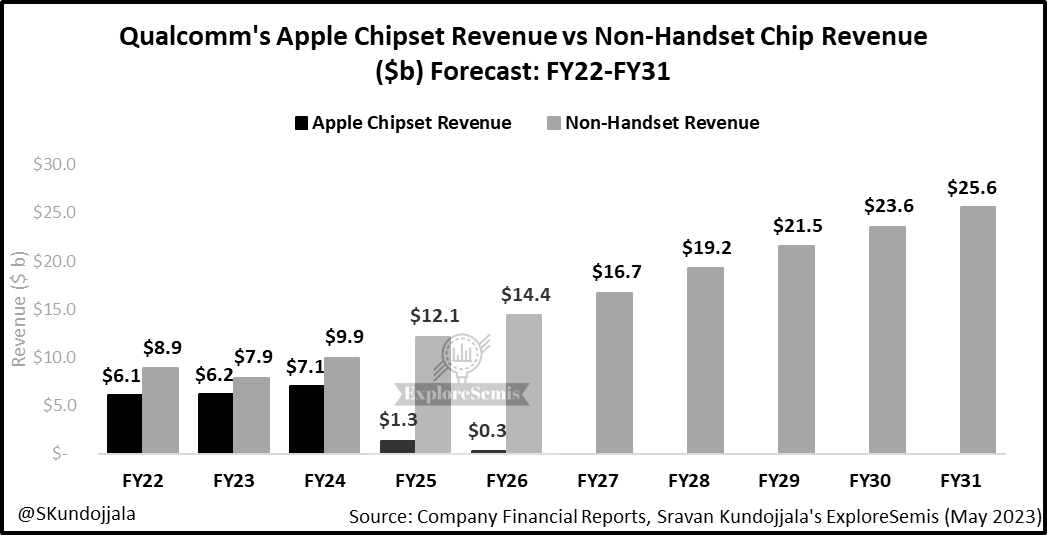

Qualcomm's semiconductor revenue diversification story has legs. Its non-handset chip revenue grew 22.6% CAGR between FY2017 and FY2022 to around $9b. With Apple chipset revenue at risk, how big those non-handset streams can grow? When will non-handset chip revenue overtake handset chip revenue? Will non-handset revenue offset Apple chipset revenue? How will Qualcomm's smartphone chip revenue trend in the next 5-10 years? What will Apple's licensing revenue forecast look like? Can Android chip revenue hold the fort?

I discussed Qualcomm's Apple dependency in part 1. I encourage you to read the post to get a view of how much revenue Apple contributes to Qualcomm and some background on the companies' relationship.

In this post, I discuss Qualcomm's semiconductor forecast by segment, Apple's revenue contribution forecast, non-handset revenue forecast and Android chip dynamics.

First, let me get into Qualcomm's semiconductor revenue forecast. The company has three key segments within its semiconductor business – handsets, auto and IoT. Almost all Apple chipset revenue falls into the handset segment though some minor income falls into the IoT segment (cellular chips for iPads etc.). Apple doesn't source any automotive components from Qualcomm.

For this calculation, I assumed Apple will introduce its first 5G modem in its 2024 iPhone model (iPhone 16). However, there is speculation that Apple will move the date to 2025 (iPhone 17). In any case, my forecast covers both bases. I have tried to model the Android and Apple smartphone growth, Qualcomm's share forecast and ASP assumptions to calculate handset revenue forecast.

The handset segment operates in a mature market. The smartphone market took a hit in recent years with reduced demand and lengthy replacement cycles. The Android segment, which is critical for Qualcomm, took a big hit in FY22 and will not likely recover until FY24.

Despite shipment decline, Qualcomm focused on its content gains (apps processor, AI, 5G, RF front-end etc.) and dramatically increased its average selling prices (ASPs) in the 5G cycle. The dynamic has helped it beat the unit weakness.

Huawei's exit and Samsung's Exynos struggles also boosted Qualcomm's handset results as the company captured a good chunk of the premium tier market left by those players. In addition, I feel that the increased process technology complexity and costs played a part in the ASP boost.

I forecast Android smartphone shipments will grow at a low-single-digit percentage in the next 5-10 years. Within that, I expect Qualcomm to maintain at least a one-third unit share though it will go up and down depending on competitive dynamics. In addition, I assumed Qualcomm's Android ASPs would recover in FY24 after declining -20%+ in FY23.

To calculate Qualcomm's Apple revenue, I forecasted Apple’s cellular-enabled device units. I expect iPhone units to remain within the 220m range (+10 m units) through the forecast period. Historical patterns and my understanding of the overall smartphone OEM dynamics inform that.

So, with that context, I expect Qualcomm's handset revenue to take a big hit in FY25 (-18% y/y) due to Apple's transition to an internally developed 5G modem. However, I expect Qualcomm to recover handset revenue gradually with the help of content gains in the Android smartphone market. As a result, I forecast Qualcomm's handset revenue will grow at 2.1% CAGR between FY25 and FY30. The Android growth is good but is not enough to satisfy investors.

Here comes auto and IoT, which have much better growth prospects than smartphones. Unsurprisingly, Qualcomm doubled down on these segments with significant acquisitions (Nuvia, Arriver, Cellwize, Autotalks etc.).

I expect Qualcomm's auto revenue to grow at a double-digit percentage for several years. With a $30b auto pipeline, Qualcomm has secured its place in the automotive market. The company made the right moves to enter the highly accretive ADAS platform market. I predict Qualcomm's automotive revenue to cross the $5b mark in FY27 and the $9b mark in FY31.

Qualcomm has multiple levers within IoT, including edge networking (Wi-Fi 7), consumer (PC, XR, tablet, wearables etc.) and industrial IoT. All three sub-segments have high growth potential. I forecast Qualcomm's IoT revenue will grow at a 10% CAGR between FY22 and FY30.

I expect the crossover between handsets and non-handsets in FY30, driven by robust growth in auto and IoT markets and the well-saturated smartphone market.

Finally, Qualcomm's growth in non-handsets suggests that the company is well placed to offset Apple's revenue of around $6b by FY27. My analysis of Qualcomm's Apple revenue streams concludes that Qualcomm can withstand this shock and is well prepared.

Also, my research does not consider any potential inorganic acquisitions by Qualcomm, which could accelerate non-handset revenue further. In addition, there is more than a good chance that Qualcomm will have some future chipset opportunities with Apple in automotive. However, this analysis assumes no revenue from such opportunities.

Hope you find this helpful. Thanks for all your support. I look forward to writing my next post.

What is your view on $qcom $arm legal spat? Revenue impact? Thanks